Samling’s Forest Crime Spree Moves to Myanmar

A coalition of Burmese civil society groups recently published a report regarding Samling Group’s palm oil operations in Myanmar. The report details land grabs, indigenous rights violations, and environmental problems, including pollution of local water sources and clear-cutting high conservation forests (HCV) inside a proposed national park that is home to endangered tigers. These environmental and human rights problems in Myanmar can all be traced back to Samling Group, a Malaysian conglomerate headquartered in Sarawak. This influential company has about 20,000 employees, is run by one of the 40 richest people in Malaysia, creates a market for deforestation palm oil at a time when most of the industry is heading in the opposite direction, and is a supplier to many leading companies around the world. For these reasons, and because of its long track record of abuse, Samling merits a closer look.

Samling’s MSPP project is located in an area with a history of violence and human rights abuses, creating an atmosphere of confusion that Samling has manipulated for financial gain. For over 60 years, the region was plagued by civil war between the Karen National Union and the central Government. Between 1997 and 2007, the Myanmar Army committed human rights violations including rape, torture, and arbitrary killings of civilians as well as looting, destruction of property, and forced labor in the MSPP area. A 2012 ceasefire agreement opened these civil war zones to foreign investment, establishing mixed administration by KNU and the Myanmar Government, such that both governments can now shift blame for MSPP’s oil palm plantation’s impacts. According to the Burmese civil society report, MSPP’s concession overlaps with 38,900 acres of community and agricultural lands incorrectly classified by the central Government as ‘vacant land’, including HVC forest that is home to tigers and approximately 4,480 Karen indigenous people. Families’ crops and orchards have been cleared, villagers indebted, and chemical run-off from MSPP’s palm oil plantations has polluted local water sources – all without fair compensation for villagers by MSPP and without Free, Prior, and Informed Consent. MSPP’s abuses illustrate high risks of investment in conflict areas in Myanmar.

These abuses are par for the course. Samling and its subsidiary Glenealy already have a documented and abysmal track record of human rights abuses against indigenous people, environmental crimes, and illegal activities that spans decades.

Brief compendium of earlier reports of Samling abuses

- Malaysia

- A compendium of abuses summarized by Forests Monitor of indigenous and forest peoples’ rights in Sarawak, Malaysia, and beyond.

- Abuses of indigenous peoples’ rights in Sarawak, Malaysia, documented by FERN.

- A report on Samling’s corruption and abuses in Sarawak by the Bruno Manser Fund and researcher Daniel Faeh of the University of Bern’s Economic Geography Group, entitled Development of global timber tycoons in Sarawak, East Malaysia – History and company profiles

- A review of environmental problems in Forests Monitor, 1998, High Stakes: The need to control transnational logging companies: a Malaysian case study.

- Systematic violations of national forestry laws in its logging concessions in Sarawak and violations of customary land rights of indigenous communities, documented by Global Witness in its “Industry Unchecked” report on Sarawak

- Illegal logging in Samling’s concessions found by the Malaysian Auditor-General.

- Complicity in systemic rape and abuse of tribal women found by the Malaysian Government

- “Extensive and repeated breaches of license terms, regulations and other requirements in all the six concession areas that were surveyed,” in a report by the Council on Ethics for the Norwegian Government Pension Fund, the world’s largest sovereign wealth fund. These breaches led to the Norwegian Pension Fund divesting from Samling.

- Liberia

- Abuses documented by Global Witness in its reports on Liberia: “Background investigations into companies bidding for Liberian forest management contracts” as well as a Briefing Paper on Samling and a follow up paper on Samling in Libera.

- Guyana

- Illegal and unsustainable timber development in Guyana detailed in an article by researchers Bulkan and Palmer

- Abuses of indigenous rights noted in the World Rainforest Movement / Amerindian Peoples Organisation, 1994, Field Survey Report

- Cambodia

- Illegal forest exploitation detailed by Global Witness

- More illegal forest exploitation detailed by Global Witness in “The Untouchables”

- Besides Malaysia, Guyana, Cambodia, Samling has a history of abuses in Papua New Guinea

- Illegal logging and abuse of indigenous people’s rights, as exposed by Greenpeace’s “Forest Crime File” and “Partners in Crime: Malaysian loggers, timber markets and the politics of self-interest in Papua New Guinea“

- Illegal activities by Samling and its controlled companies Concord Pacific and Bismarck Industries operating in PNG, according to Forest Trends

We believe Samling should immediately stop MSPP’s current operations, compensate villagers for all past harms, restore an area at least equivalent to what it has destroyed, and obey the law of the land. Samling must meet the industry benchmark for responsible production by immediately announcing a comprehensive cross-commodity No Deforestation, No Peat, and No Exploitation policy in adherence with the HCSA methodology for its operations and supply chain.

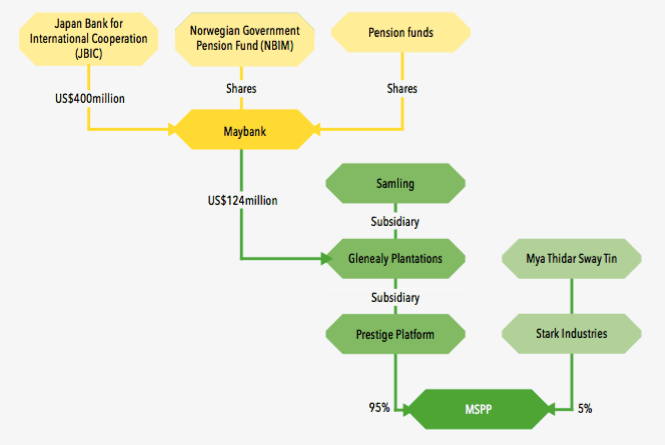

Should Samling not agree to these steps, Maybank should divest from Samling. All Maybank investors should require immediate action by Maybank to divest from companies driving deforestation, peatland clearance, and human rights abuse, including Samling and its subsidiaries. (Maybank is also likely financing rogue palm oil trader Sunfield Global, who is buying from Sarawak peatland destroyer BLD/Kirana.) According to the recent Burmese civil society report investors in Maybank include the Norwegian Sovereign Wealth Fund, the Japan Bank for International Cooperation, PGGM (Netherlands), British Columbia Investment Management (Canada, APG Asset Management (Netherlands), TIAA Global Management (United States), CPP Investment Board (Canada), Forsta AP-Fonden (Sweden), Caisse de Depot et Placement du Quebec (Canada), and AMF Pensions for sakring (Sweden).

Featured image from a_rabin.